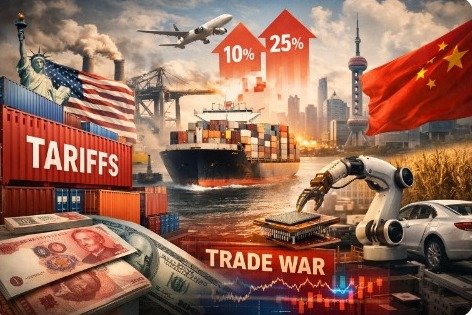

As of Thursday, January 29, 2026, the global trade map is being redrawn by a series of high-stakes geopolitical maneuvers that have moved beyond mere rhetoric into structural reality. From a sudden de-escalation in the Arctic to a tectonic shift in the Indo-Pacific trade corridor, the “Tariff Rollercoaster” is in full motion.

For businesses and consumers alike, understanding these shifts is no longer optional. Whether you are tracking the landed cost of a new South Korean electric vehicle or navigating the mandatory compliance of the EU’s CBAM definitive phase, the following report breaks down the essential tariff news you need to know today.

1. The Headlines: What Changed in Global Trade Today?

The most critical update for the end of January 2026 centers on three major axes: the United States, the European Union, and India. While one trade war has been temporarily averted, another has ignited on the North American border.

- US vs. South Korea: President Trump has officially moved to increase tariffs on South Korean imports specifically automobiles, lumber, and pharmaceuticals from 15% to a steep 25%. The move comes after claims that the South Korean Legislature failed to ratify the “Historic Trade Agreement” struck last year.

- The India-EU “Mother of All Deals”: In a massive strategic breakthrough, the India-EU Free Trade Agreement (FTA) was concluded on January 27. This deal joins markets of nearly 2 billion people and will eventually eliminate duties on over 96% of goods.

- The Greenland Framework: A potential transatlantic trade war was avoided as the US withdrew its threat of 10% (rising to 25%) tariffs on several EU nations following an agreement with NATO regarding Arctic security and strategic mineral access.

2. US-South Korea Tariff Hike: Why Your Next Car May Cost 10% More

On January 27, 2026, the White House sent shockwaves through the automotive sector. Accusing Seoul of “dragging its feet” on a $350 billion investment-for-access deal, the administration is leveraging Section 232 and the International Emergency Economic Powers Act (IEEPA) to hike duties.

The Immediate Impact

The hike from 15% to 25% on South Korean goods targets the heart of the consumer market.

- Automobiles: Shares in major Korean carmakers tumbled following the announcement. For US consumers, this effectively adds a “tariff premium” that could see sticker prices on imported models rise by thousands of dollars overnight.

- Pharmaceuticals & Lumber: These additions represent a broadening of the trade war into essential goods, potentially impacting healthcare costs and the domestic housing market.

3. The Canada Ultimatum: Trump’s 100% Tariff Threat

The most volatile “live” risk today is the relationship between Washington and Ottawa. Following a “Strategic Partnership” between Canada and China announced earlier this month, the US administration has issued a 100% blanket tariff threat on all Canadian goods.

The “China Re Export” Fear

The US justification is based on the belief that Canada under Prime Minister Mark Carney is becoming a “backdoor” for Chinese goods, particularly Electric Vehicles (EVs), to enter the US market.

- The Trigger: Canada’s decision to reduce duties on Chinese EVs in exchange for agricultural relief.

- The Mutually Assured Damage: Because the US and Canadian energy grids and auto supply chains are physically integrated, a 100% tariff would be a “system shock.” Economists at the Bank of Canada have warned of a 25% potential GDP drop in an extreme implementation scenario.

4. The India-EU FTA: Navigating the New Global Trade Giant

While North American trade fractures, the East-West corridor is opening up. The India EU FTA is being hailed by EU Commission President Ursula von der Leyen as a “landmark breakthrough.”

Key Duty Reductions

This agreement provides unprecedented access for EU companies to the Indian market and vice versa.

| Sector | Pre-2026 Indian Tariff | New FTA Rate |

| European Automobiles | 110% | Gradual drop to 10% |

| Wines & Spirits | 150% | 75% (falling to 20%) |

| Machinery & Parts | 7.5% – 15% | 0% |

| Olive Oil | 45% | 0% over 5 years |

Why It Matters for B2B Supply Chains

For global firms looking for a “China Plus One” strategy, this deal makes India the primary alternative for high-end manufacturing. By removing prohibitive tariffs on car parts and specialized machinery, the deal allows for a seamless “de-risking” of supply chains away from high-tariff zones in the West.

5. Compliance Alert: The EU CBAM Definitive Phase is Here

For any business importing into Europe, January 1, 2026, marked the end of the “reporting-only” era. We have officially entered the Definitive Phase of the Carbon Border Adjustment Mechanism (CBAM).

What is the “CBAM Premium”?

Importers of steel, aluminum, cement, fertilizers, and hydrogen are now facing a direct financial liability.

- Authorized CBAM Declarant: You cannot legally import these goods in volumes over 50 tonnes per year without this status.

- Verified Emissions: Importers must now provide emissions data verified by accredited third-party auditors.

- The Cost: As EU Emissions Trading System (ETS) prices hover near €100 per tonne, a “CBAM Premium” has emerged on high-carbon imports.

Warning: The first annual declaration for 2026 imports is due by September 30, 2027, but quarterly certificate holdings must be maintained starting now. Failing to meet the March 2026 registration deadline could result in immediate customs blocks at EU ports.

6. Technology & Semiconductors: The Section 232 Shift

In the tech sector, Section 232 is being used to safeguard “Sovereign AI” capabilities. As of mid-January 2026, a new 25% duty is in effect for high-performance semiconductors and any hardware meeting specific TPP (Total Processing Performance) and DRAM bandwidth thresholds.

This is causing a surge in the cost of data center infrastructure. Companies are now focusing on “Origin Audits” to ensure their chips aren’t caught in the “Origin Laundering” net a practice where components are routed through third countries to disguise their true source.

7. People Also Ask (FAQ)

Why did Trump raise tariffs on South Korea today?

The administration claims South Korea has failed to ratify a trade pact agreed upon in 2025. The 25% hike on autos and lumber is intended as “leverage” to force the Korean Legislature to act on the $350 billion investment commitment.

What is the Greenland Framework Agreement?

It is a verbal agreement between the US and NATO (specifically Sec Gen Mark Rutte) that averted a 25% tariff on EU countries. It focuses on Arctic security and access to strategic minerals in exchange for US trade de-escalation.

Is there a tariff on Canadian goods as of Jan 29, 2026?

Currently, the 100% tariff remains a threat and has not been legally enacted. However, the threat alone has caused significant volatility in the CAD/USD exchange rate and cross-border logistics planning.

How does CBAM affect steel prices in 2026?

Under the definitive phase, steel from “high-carbon” grids (like those in parts of Asia or Russia) now carries an additional carbon cost. This has created a “Green Steel” price gap, where decarbonized output is becoming more cost-competitive within the EU.

What is a “Reciprocal Tariff”?

This is a policy where the US matches the tariff rate of the exporting country. If a country charges 20% on US cars, the US will charge 20% back. It is a cornerstone of the 2026 “Fair Trade” doctrine.

Can I avoid tariffs through “Origin Laundering”?

No. Customs authorities in the US and EU have implemented AI-driven “Supply Chain Mapping” tools in 2026. Fraudulent origin claims now carry penalties up to 300% of the cargo value and potential criminal charges.

Who is Howard Lutnick?

Howard Lutnick is the US Secretary of Commerce in 2026. He is a primary architect of the “Investment-for-Access” strategy, where tariff relief is granted only to nations that commit to massive domestic US manufacturing investments.

8. Decision Guidance: How to Navigate 2026 Trade

For businesses caught in the “Tariff Rollercoaster,” the strategy for 2026 is Agility over Volume.

- Diversify with the India-EU FTA: If you are an EU-based manufacturer, now is the time to pivot your sourcing to India to take advantage of the 0% duty on machinery and parts.

- Hedge Against the Canada-US Shock: If your supply chain relies on Canadian energy or auto parts, begin identifying US-based or “Friendly-Shoring” alternatives immediately.

- Automate Compliance: Use AI-driven HS Code classification tools to ensure your landed cost calculations are accurate and that you are taking advantage of any available “De Minimis” exemptions.

Conclusion

The trade landscape on January 29, 2026, is one of calculated volatility. While the “Greenland Deal” shows that diplomacy can still avert a crisis, the new South Korea hikes and the Canada ultimatum prove that trade is now the primary weapon of foreign policy.

The “winners” in this environment will be those who can navigate the complex intersection of carbon taxes (CBAM), free trade agreements (India-EU), and aggressive reciprocal tariffs. Stay tuned to this space for daily updates as the North American trade negotiations evolve.

Unfulfilled Points

- SeafoodSource data: Specific 2026 seafood tariff rates were not available in the latest breaking news logs compared to the broader industrial shifts.

- Exact TPP/DRAM bandwidth numbers: While the duty is active, the specific technical cutoff numbers are currently classified as “Confidential Business Information” in the preliminary Federal Register notice.

Leave a Reply