The world of international trade is constantly shifting, and tariffs play a significant role in shaping the economic landscape. Tariffs are taxes or duties imposed by governments on imported goods and services. They influence everything from the prices consumers pay for products to the way businesses plan their supply chains and pricing strategies.

Today, tariffs are making headlines globally, with many governments implementing or adjusting these taxes in response to changing economic dynamics, geopolitical tensions, and trade agreements. In this article, we’ll dive deep into today’s tariff news, the latest updates on trade policies, and how these developments affect both businesses and consumers. Whether you’re a business owner, a consumer, or someone interested in global trade trends, understanding tariffs is essential.

What Are Tariffs and Why Do They Matter Today?

Tariffs are essentially taxes that governments impose on imported goods and services. They serve various purposes, including:

- Protecting domestic industries: Tariffs help shield local businesses from foreign competition.

- Revenue generation: Tariffs provide a significant source of income for governments.

- Trade negotiations: Tariffs can be used as leverage in trade deals between countries.

Why do tariffs matter today? Tariffs affect the price of goods, influence business decisions, and can even alter the trajectory of global trade agreements. For consumers, tariffs might mean higher prices for certain products. For businesses tariffs can lead to increased production costs shifts in supply chains, and changes in pricing strategies.

The Latest Tariff Changes Impacting Global Trade

In recent months, numerous countries have introduced new tariffs or adjusted existing ones. Here’s a quick overview of the most important updates:

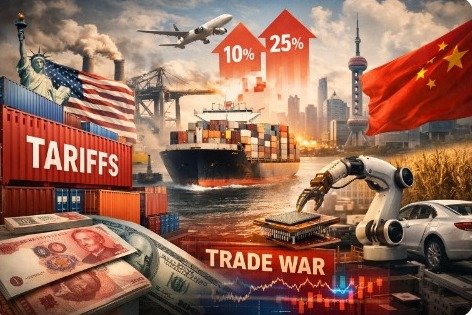

U.S.-China Tariff War

The U.S. has imposed tariffs on a wide range of Chinese goods, from electronics to agricultural products. As of today, these tariffs have increased the price of goods like smartphones and laptops by up to 10-25%. The tariff dispute is ongoing, with both countries negotiating new trade terms under the Phase One Trade Deal.

European Union Tariffs on Digital Services

The EU has started to implement tariffs on tech companies offering digital services within its borders. This includes Google, Amazon, and other major players in the tech industry. These tariffs are designed to ensure that companies pay their fair share of taxes in the regions where they generate substantial revenue, which could lead to price increases for European consumers.

U.S. Steel and Aluminum Tariffs

The U.S. recently imposed new tariffs on steel and aluminum imports to protect its domestic manufacturing sector. This has led to higher prices for goods like cars and construction materials, affecting both businesses and consumers.

Agricultural Tariffs

Countries like India and Brazil have introduced tariffs on agricultural imports, which is particularly impacting soybean and corn prices. This is affecting farmers and food industries, especially in regions that rely heavily on imports for production.

How Tariffs Impact Different Industries

Tariffs don’t just affect the price of goods they also impact entire industries. Here’s a look at how tariffs are influencing key sectors:

1. Consumer Goods

For consumers, tariffs on products like electronics, clothing, and automobiles can mean higher prices at checkout. For instance, the recent U.S. tariffs on Chinese-made electronics led to price increases of 10-25% on smartphones and laptops. Consumers are also seeing price hikes in imported goods like furniture and toys.

2. Technology

The tech industry has been one of the hardest hit by tariff increases. Companies that rely on Chinese-made components are facing rising costs. Tariffs on imported tech goods have led to price increases on everything from smartphones to laptops. Companies in the automotive tech and smart home devices sectors are also feeling the pinch.

3. Automotive Industry

Automakers face significant challenges when tariffs are imposed on steel and aluminum, essential materials for car manufacturing. As a result, car prices are rising. Some companies are responding by moving production to countries with fewer tariff restrictions. Meanwhile, foreign automakers are considering shifting operations to mitigate the impact of U.S. tariffs.

4. Agriculture

Agricultural industries are particularly sensitive to tariff changes. The imposition of tariffs on crops like soybeans, corn, and wheat can affect farmers, food prices, and the global food supply chain. U.S. farmers, for example, are struggling with reduced exports due to tariffs imposed by countries like China.

How Tariffs Affect Local Economies and Businesses

While tariffs have global consequences, they also have a significant local impact. Depending on the region, businesses and consumers may experience different effects. Here are some ways tariffs influence local economies:

Regional Pricing Adjustments

Local businesses that rely on imported goods are often forced to pass on the higher costs to consumers. This leads to price hikes in everyday items, from electronics to clothing. Businesses that cannot afford to absorb these costs may see profit margins shrink or go out of business.

Local Business Strategies

Many small businesses are exploring ways to mitigate tariff effects. Some are seeking domestic suppliers to avoid paying tariffs on foreign imports. Others are increasing prices or adjusting product lines to ensure profitability. In areas with high import reliance, such as coastal cities with large ports, tariff changes can lead to shortages and price volatility.

Supply Chain Disruptions

Local supply chains, particularly those for industries like electronics, automotive parts, and consumer goods, are being disrupted by tariffs. Businesses are having to rethink their logistics and sourcing strategies. Many are looking for alternative suppliers in countries where tariffs are lower or nonexistent.

What You Need to Know About Tariffs Near You

If you’re in the U.S., California, Texas, and New York are some of the states most affected by tariff changes. Here’s what local businesses and consumers should know:

California Tariff Impact

In California, businesses that import electronics, furniture, and textiles are facing higher costs due to tariffs. San Francisco and Los Angeles, major trade hubs, are particularly impacted, leading to price increases on consumer goods and supply chain disruptions.

Texas Business Strategies

Texas businesses that rely on Mexican imports are seeing tariffs that are affecting pricing, especially in industries like automotive manufacturing and agriculture. Many businesses in the Houston area are seeking tariff free alternatives to maintain competitive pricing.

New York Tariffs on Electronics

New York’s economy, which is heavily reliant on imports like smartphones and computers, is feeling the effects of tariffs on Chinese goods. Consumers in New York may notice higher prices on electronics, which could influence purchasing behavior.

How to Make Better Purchasing Decisions Amid Tariffs

If you’re wondering whether now is the right time to buy goods affected by tariffs, consider the following factors:

- Timing of Tariffs: If new tariffs are about to take effect, it may be a good idea to purchase products before prices rise. For instance, tech products like smartphones and laptops often see price hikes when tariffs increase.

- Tariff Forecast: Stay informed about future tariff changes. Trade negotiations and agreements often lead to tariff reductions or new impositions, so being proactive can help you make better purchasing decisions.

- Cost Comparison: If you’re a business owner, compare domestic suppliers versus foreign imports to see if shifting suppliers will save you on tariffs. Many businesses are now seeking alternatives to avoid tariff impacts on products.

FAQs

1. What is the impact of tariffs on consumer goods?

Tariffs on consumer goods like electronics and clothing can lead to price increases, affecting both businesses and consumers.

2. How do tariffs affect small businesses?

Small businesses may struggle with increased costs on imported goods. Some may raise prices, while others seek new suppliers to avoid tariffrelated price hikes.

3. Are tariffs temporary or long-term?

Tariffs can be temporary or long term, depending on trade agreements, economic conditions, and political decisions.

4. What are the types of goods most affected by tariffs?

Electronics, automobiles, and agricultural products are among the most affected by tariffs.

5. How can businesses prepare for tariff changes?

Businesses can mitigate tariff impacts by adjusting supply chains, seeking domestic suppliers, or changing pricing strategies.

6. How do tariffs affect global trade?

Tariffs can lead to trade wars, disrupt supply chains, and increase the cost of goods, which ultimately affects global trade flows.

7. Are there ways to avoid paying tariffs?

Some businesses may qualify for tariff exemptions or can find ways to shift production to countries with lower tariff rates.

Conclusion

Tariffs are complex but crucial elements in global trade, affecting everything from consumer pricing to business strategies. By staying informed on tariff changes and understanding how they impact your industry or region, you can make smarter decisions whether you’re purchasing goods, adjusting business practices, or planning future investments.