Introduction

The United States’ sudden control and sale of Venezuelan oil has triggered a political firestorm in Washington and sent shockwaves through the global energy market. Following the dramatic capture of Venezuelan President Nicolás Maduro, the Trump administration moved quickly to unlock and sell oil from Venezuela’s vast reserves an unprecedented move that has generated millions of dollars and just as many questions.

At the center of the controversy are allegations of corruption, lack of oversight, and political favoritism. Lawmakers, industry insiders, and international observers are now scrutinizing who benefits from the oil sales, how the proceeds are handled, and whether the United States is steering Venezuela toward democracy or merely toward a more convenient form of authoritarian rule.

The Context: How the U.S. Came to Control Venezuelan Oil

Venezuela holds the largest proven oil reserves in the world, estimated at more than 300 billion barrels. For years, those reserves were effectively locked away due to U.S. sanctions, mismanagement by the Maduro government, and geopolitical tensions.

That changed abruptly after U.S. forces captured Maduro and his wife, Cilia Flores de Maduro, on charges related to narcotrafficking and narco-terrorism. With Maduro jailed and awaiting federal trial in the United States, President Donald Trump announced that Washington would oversee Venezuela’s oil assets during a transitional period.

Trump framed the move as a national security necessity.

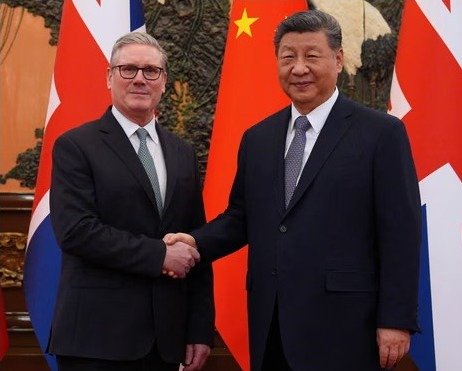

According to the administration, Venezuelan oil had been enriching foreign adversaries such as Iran and China. By taking control, the U.S. claimed it could stabilize the region, weaken criminal networks, and redirect profits toward rebuilding Venezuela—while also benefiting American energy interests.

The $2 Billion Oil Deal That Set Off Alarm Bells

Within weeks of Maduro’s capture, the Trump administration unveiled a sweeping $2 billion deal to sell Venezuelan oil. The crude, previously off-limits to most American firms, began flowing into refineries in Houston. Trump himself confirmed the shipments in a January interview, bluntly stating, “We take the oil.”

So far, roughly $500 million worth of oil has already been sold, according to sources familiar with the transactions. Some of the proceeds have reportedly been deposited into a Qatari bank account controlled at the discretion of the Trump administration, while other funds were distributed through Venezuelan banks.

This lack of transparency is what immediately raised red flags.

Congressional Scrutiny and Political Backlash

Democratic lawmakers have been vocal in their criticism, arguing that the oil sales operate in a legal gray zone with little accountability.

Senator Chris Murphy of Connecticut described the arrangement as “murky and ripe for corruption,” suggesting the administration was positioning Trump-aligned interests to profit from Venezuela’s resources. Murphy and other senators have demanded disclosures of any financial ties between Trump officials and companies involved in the oil trade.

In January, more than a dozen Democratic senators sent letters to major banks asking whether they were approached to hold Venezuelan oil proceeds. A separate letter demanded that Trump administration officials disclose any personal financial interests connected to oil extraction, processing, or trading.

The controversy is expected to take center stage when Secretary of State Marco Rubio testifies before a Senate committee on January 28.

Who Is Handling the Oil Sales?

One of the most contentious aspects of the deal is the selection of two commodity trading giants Vitol and Trafigura to handle the initial oil sales.

Both firms are among the largest energy traders in the world, but both also carry baggage.

- Vitol previously agreed to pay $135 million in criminal penalties related to bribery schemes in Ecuador, Brazil, and Mexico.

- Trafigura pleaded guilty to violating U.S. anti-corruption laws and paid more than $126 million over bribery allegations involving Brazilian oil officials.

Adding to the controversy, reporting revealed that a senior Vitol trader involved in securing the Venezuela deal donated millions of dollars to Trump’s reelection campaign.

Critics argue that granting licenses to these firms without a competitive or transparent process undermines confidence in the administration’s claims of integrity.

The Administration’s Defense

The White House has rejected accusations of wrongdoing. Officials argue that Vitol and Trafigura were selected because of their ability to move large volumes of oil quickly in a complex and volatile environment.

According to administration sources, future oil sales will be opened to additional traders and refiners. Reuters reported that the U.S. plans to expand licensing to other companies, potentially easing some concerns about favoritism.

White House spokesperson Taylor Rogers defended the strategy, stating that Trump’s actions prevented Venezuelan oil from funding criminal networks and strengthened U.S. national security.

Where the Money Is Going and Why It Matters

One of the most unresolved issues is how oil revenues are managed.

An executive order signed on January 9 designated oil revenue as funds held by the U.S. government “on behalf of the Government of Venezuela.” However, experts say this places the money outside standard U.S. regulatory frameworks.

Francisco Rodríguez of the Center for Economic and Policy Research noted that it remains unclear what legal standards govern these funds or how decisions about their use are made.

Some proceeds were transferred to four Venezuelan banks, which then sold dollars to domestic companies needing foreign currency. Critics question why those specific banks were chosen and what safeguards exist to prevent misuse.

Sanctions, Seizures, and Mixed Signals

Despite opening oil sales, the Trump administration has not fully lifted sanctions on Venezuela. U.S. forces continue to seize oil tankers in the Caribbean suspected of supplying adversaries like China and Iran.

This dual approach selling oil while maintaining aggressive enforcement has created uncertainty for energy companies considering investments in Venezuela.

At a White House meeting with oil executives, Trump attempted to entice major players to return. When ExxonMobil CEO Darren Woods expressed hesitation due to past asset seizures, Trump reportedly dismissed the company as “playing too cute,” signaling a willingness to exclude firms that don’t move quickly.

Delcy Rodríguez and Venezuela’s New Power Structure

With Maduro gone, Vice President Delcy Rodríguez assumed leadership, earning cautious praise from Trump. According to the administration, Rodríguez has committed to opening Venezuela’s energy sector to American companies and using oil revenues to purchase U.S. goods.

She recently introduced sweeping legal reforms that would:

- Allow private companies to control oil projects

- Remove requirements for government approval of oil contracts

- Codify concessions long sought by foreign investors

Energy experts describe the reforms as a major shift one that effectively delivers what oil companies have been requesting for over a decade.

Yet Rodríguez’s public statements reveal tension. While cooperating with U.S. demands, she has criticized Washington’s interference and warned against foreign control over Venezuela’s future.

Democracy vs. Oil: The Core Ethical Question

Perhaps the most uncomfortable question raised by the oil sell off is whether democracy is truly the goal.

Opposition leader María Corina Machado, whose party claims victory in the 2024 presidential election, has pushed for U.S. backing to restore democratic governance. International observers largely agreed that her party won, despite Maduro’s refusal to step down at the time.

Trump has rebuffed Machado’s efforts, saying elections will occur “at the right time,” without offering a timeline. Instead, the administration appears focused on stability, energy access, and compliance with U.S. demands.

Venezuela has increased acceptance of migrant deportation flights and released hundreds of political prisoners since Maduro’s removal. While these moves are significant, critics argue they fall short of genuine democratic transition.

Global Energy Implications

The sale of Venezuelan oil has implications far beyond U.S. politics.

- Increased supply could affect global oil prices

- U.S. refiners gain access to heavy crude suited to Gulf Coast facilities

- China and Iran may lose influence in Latin American energy markets

At the same time, uncertainty about governance and legality may discourage long-term investment, limiting Venezuela’s ability to rebuild its energy sector sustainably.

What Comes Next?

As Senate hearings approach and additional licenses are considered, pressure is mounting for transparency and oversight. Key questions remain unanswered:

- Who ultimately controls Venezuela’s oil revenue?

- How are companies selected for licenses?

- Will democratic elections actually take place?

- Can corruption risks be effectively managed?

The answers will shape not only Venezuela’s future but also how far the United States is willing to go in blending foreign policy, energy security, and economic opportunity.

FAQs

Why is the U.S. selling Venezuelan oil now?

The Trump administration says control of oil assets is necessary after Maduro’s capture to prevent criminal use and stabilize Venezuela.

How much oil has been sold so far?

Roughly $500 million worth of oil has already been sold, according to reported sources.

Who is handling the oil sales?

Initial sales were licensed to Vitol and Trafigura, two major global commodity traders.

Why are lawmakers concerned about corruption?

Critics cite lack of transparency, past bribery cases involving traders, and unclear handling of proceeds.

Is Venezuela moving toward democracy?

Some reforms and prisoner releases have occurred, but elections have been postponed without a clear timeline.

What role does Delcy Rodríguez play?

She serves as interim president and is pushing legal reforms to open Venezuela’s energy sector.

Could this affect global oil prices?

Yes. Increased Venezuelan supply could influence regional and global energy markets.

Conclusion

The Trump administration’s sale of Venezuelan oil marks one of the most controversial foreign policy and energy decisions in recent years. While framed as a bold move to restore security and prosperity, the deal has exposed serious concerns about transparency, accountability, and long-term intentions.

As billions of dollars and a nation’s future hang in the balance, the coming months will reveal whether this strategy becomes a model for intervention or a cautionary tale of power, profit, and unresolved democracy.

Leave a Reply