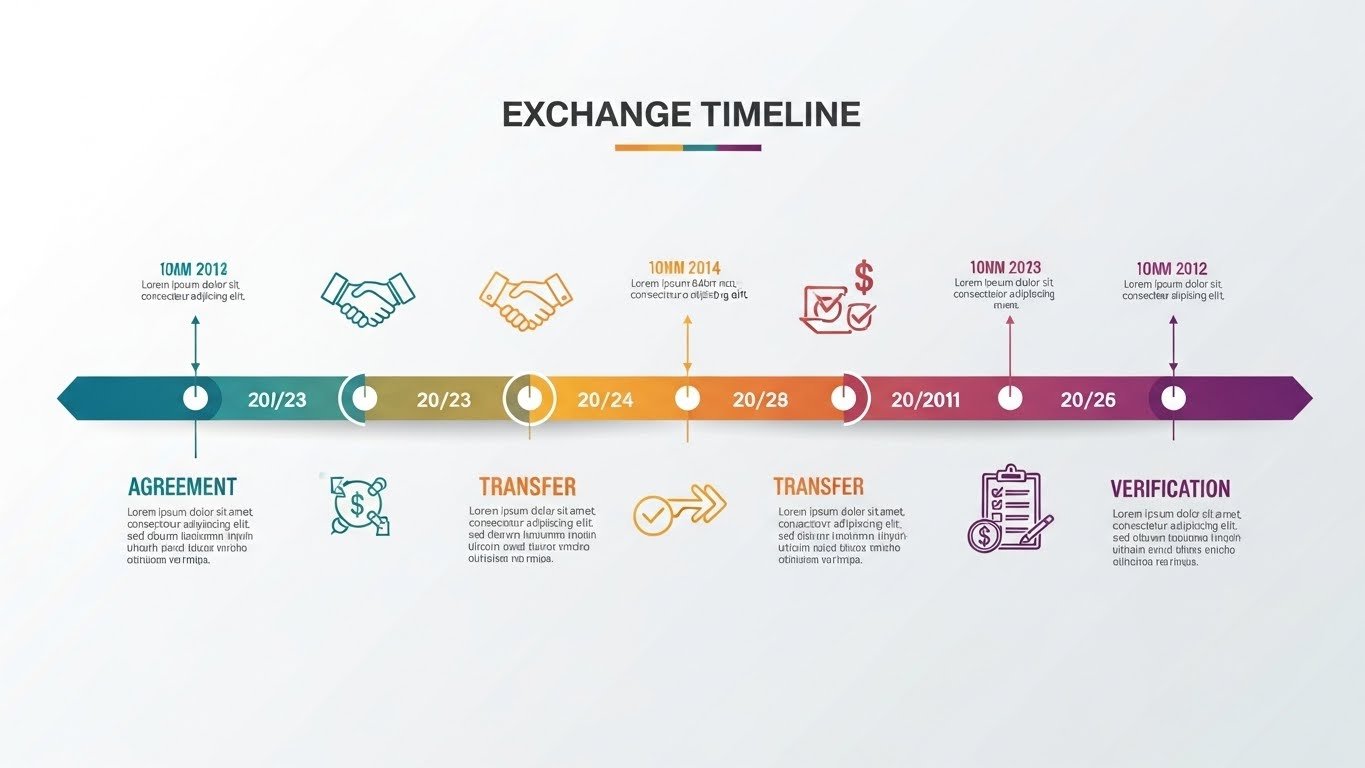

Understanding the 1031 Trade Timeline

A 1031 trade timeline characterizes strict due dates for conceding capital picks up taxes.

It applies when offering venture or trade genuine estate.

Therefore, timing exactness gets to be basic for compliance.

Moreover, lost a due date can preclude the whole exchange.

As a result, financial specialists must take after each step carefully.

What Triggers the 1031 Trade Clock

The timeline begins the day the surrendered property closes.

That date is known as Day Zero.

From this point, the IRS commencement begins.

Consequently, arrangement some time recently closing is critical.

Otherwise, financial specialists confront superfluous pressure.

Day 0: Deal of the Surrendered Property

The trade authoritatively starts at closing.

Funds move to a qualified mediator immediately.

Importantly, financial specialists never touch the proceeds.

Otherwise, the trade gets to be invalid.

Thus, selecting an middle person early things greatly.

Days 1–45: Recognizable proof Period Explained

The to begin with major due date is the 45-day recognizable proof period.

During this 1031 Exchange Timeline, substitution properties must be identified.

Additionally, distinguishing proof must be composed and signed.

Furthermore, it must be conveyed to the intermediary.

No expansions exist beneath ordinary circumstances.

Rules for Recognizing Substitution Properties

The IRS permits three fundamental recognizable proof rules.

First, the Three-Property Run the show licenses recognizing three properties.

Second, the 200 Percent Run the show permits more alternatives beneath esteem limits.

Third, the 95 Percent Run the show applies in uncommon situations.

Therefore, methodology choice depends on financial specialist goals.

Why Early Property Inquire about Is Essential

Successful trades begin some time recently the deal closes.

Ideally, financial specialists investigate properties in advance.

Meanwhile, showcase examination diminishes choice stress.

Consequently, bargains move quicker amid identification.

This approach progresses victory rates significantly.

Days 46–180: The Trade Period

After distinguishing proof, the trade period continues.

Investors have 180 days to total purchases.

Importantly, this incorporates the starting 45 days.

Therefore, as it were 135 days stay after identification.

Time administration gets to be significant at this stage.

Closing on the Substitution Property

Replacement property closings must happen inside 180 days.

Additionally, titles must coordinate the surrendered ownership.

Otherwise, the trade comes up short IRS requirements.

Hence, legitimate survey guarantees auxiliary compliance.

Professional direction diminishes expensive errors.

Understanding Like-Kind Property Requirements

Like-kind property alludes to speculation intent.

It does not require indistinguishable property types.

For case, arrive can trade for apartments.

However, individual homes do not qualify.

Thus, utilize expectation characterizes eligibility.

Role of the Qualified Intermediary

A qualified middle person encourages the whole process.

They hold stores and oversee documentation.

Moreover, they guarantee IRS compliance.

Choosing an experienced mediator is vital.

Their skill secures the trade structure.

Common Timeline Botches to Avoid

Many speculators miss recognizable proof deadlines.

Others disgracefully depict properties.

Additionally, a few get reserves directly.

Each botch discredits the exchange.

Therefore, consideration to detail is mandatory.

How Expansions Influence the 1031 Trade Timeline

Generally, the IRS does not give extensions.

However, governmentally announced fiascos may qualify.

Even at that point, alleviation is limited.

Thus, depending on expansions is risky.

Proactive arranging remains the best strategy.

Tax Detailing After Completing the Exchange

Investors must report trades utilizing IRS Shape 8824.

This frame goes with the yearly assess return.

Accurate announcing guarantees proceeded assess deferral.

Therefore, recordkeeping remains essential.

Professional charge counsel includes additional protection.

Benefits of Taking after the Rectify Timeline

A compliant timeline jam capital picks up deferral.

As a result, speculators reinvest more capital.

Furthermore, portfolio development accelerates.

Over time, wealth-building openings expand.

Thus, teach straightforwardly underpins budgetary success.

Final Considerations on the 1031 Trade Timeline

The 1031 trade timeline requests exactness and planning.

Every day carries legitimate importance.

Therefore, early arrangement decreases stress.

Additionally, master bolster progresses outcomes.

Ultimately, acing the timeline opens effective assess focal points.